Our Lenders

We work with Lending Expert to give you access to a panel of leading lenders well placed to meet your needs at the lowest rates.

Yes, it is possible to stop a payday loans company from taking an upcoming payment from you and this can be achieved through a combination of writing to them, emailing them and contacting your bank.

When you agree to taking out a payday loan, you will typically sign an online loan agreement and this confirms that you allow the lender to automatically collect repayments from you on the schedule repayment date (usually the last Friday or working day of the month). Your repayments are collected via a process called continuous payment authority, which is similar to setting up a direct debit. The lender must have this direct debit in place before funding your loan and it is common that they will tokenise your debit card when you apply.

The collection practices of lenders follow strict regulation by the Financial Conduct Authority which means that they must send you follow ups on the days leading up to each collection (usually by email and SMS) and on the day that payment is due, there is a limit to the number of times that they can ‘ping’ your account for repayment, which is around 3 times. Before the regulation kicked in, lenders would try every 5 minutes!

Why Would I Ask a Payday Lender To Stop Taking Money From My Account?

Whilst your repayments are due by the terms of this contract, you may find that you are not in a financial position to have the repayment fully collected (which could be the full loan amount and interest). Instead, you would prefer the money to be used elsewhere and for something more pressing like buying groceries or paying your rent.

Although you can request for the upcoming payment to not be taken from your bank account, it is important to know that your loan will likely fall into arrears which could incur late fees, penalties (max £15) and a negative impact to your credit score. Hence, you will still be liable for the repayment and delaying it will make it more expensive and compromise your credit score.

What Are The Steps To Stopping a Payday Lender From Taking Payments From My Account?

1. Contact The Lender

You can start by contacting your direct payday lender and there will be contact details on their website. You can call them, email them or write to them. Whichever option you select, be sure to have your loan reference number handy which will be on the loan agreement you signed or any correspondence that you have with them. Be ready that if you speak to them, they might ask you for a partial repayment which you have choose to make or not.

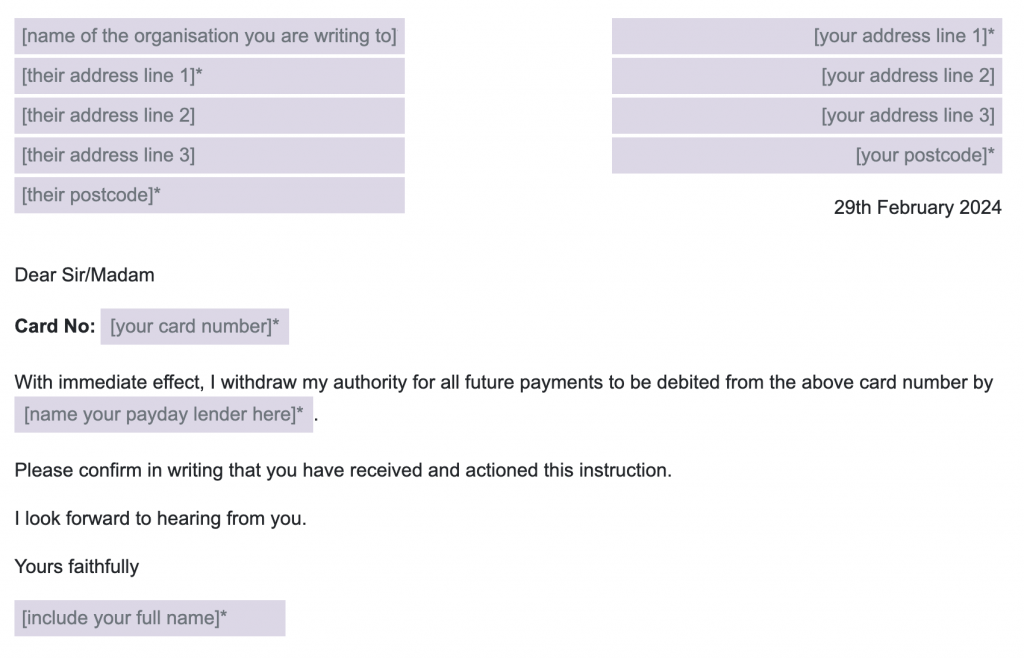

Some debt charities say you should write a formal letter to the lender, which can be sent in the post or by email (I would think email is preferred since various lenders use their accountant’s addresses and it could take a few days or weeks longer to get to them).

Here is a sample letter template you can use:

Loan reference no.

Source: https://www.nationaldebtline.org/sample-letters/withdraw-cpa-card-issuer/

2. Contact Your Bank

On the other end, you can also ask your bank to cancel the continuous payment authority or direct debit. Given that it is your account and you initially authorised it, you can ask them to cancel it. You may be able to do this on an online banking app, otherwise you may need to call them up and speak to customer services. This should have the same impact in order to cancel the upcoming payment.

What Other Options Do I Have? Try Clear The Outstanding Amount

Of course if you want to stop a payday lender from taking money from your account, this will not happen if you clear the account in full.

If you have repaid the loan in full, there will be no more debt outstanding and therefore they will no longer try to take money from your account.

If you are having trouble repaying your loan, you can speak to them about an alternative arrangement. This might include:

- Extending the terms of your loan so you have a longer period to pay (known as an instalment loan)

- Creating different repayment terms that spread the payment and break it into smaller amounts (known as an arrangement to repay) – this will be marked on your credit report and show negatively on your credit score

- You could consolidate outstanding payday loans into a debt consolidation loan, which is a larger loan that combines multiple debts into one single loan. The idea is that if you pay off this one loan, you will clear all your debts and become debt free.

What Are The Implications if I Stop a Payday Loans Company From Taking Payment From My Bank Account?

Whilst you might be empowered by getting a payday loan company to stop taking a payment from you, this is not a good idea or advised. Since you signed the payday loan agreement and accepted the terms of the loan when you received it, you are therefore liable to see through the end of the loan and make full repayment on it.

By stopping your repayment coming up, your loan will automatically go into arrears and this will have negative consequences including:

- Late fee penalty added (maximum £15 per month)

- Daily interest will continue to add up. If your loan is open for another 10 or 20 days, you will pay an extra 10 or 20 days of interest

- Late payment will be marked on your credit report and cause your credit score to fall, making it harder to access credit cards and loans in the future.