What is a Senior Stretch Loan?

A senior stretch loan can help you purchase a property …

If you have purchased a car through a dealership using PCP finance between 2007 and 2021, you may be eligible for some kind of compensation or payout for being overcharged. Whilst the claims are in their early days, the average claim and refund to British motorists could be anywhere from £300 to £1,000 because the rate charged was set by the broker or car dealer and not according to FCA guidelines.

In Partnership With

PCP Finance is the most commonly used way to buy a car in the UK, with around 90% of cars bought in this way. This type of finance essentially allows you to spread repayments with the option to buy the car at the end of trade it in.

PCP Finance starts by making an initial deposit of around 20% (or trading in an existing vehicle you own) and paying monthly payments of interest usually for 3 to 4 years, when finally you will have the option to buy the car outright, known as a ‘balloon payment’ or you can trade the car for another and start again.

The other alternatives, which are used less, are called Hire Purchase (HP), Leasing or just simply getting a personal loan.

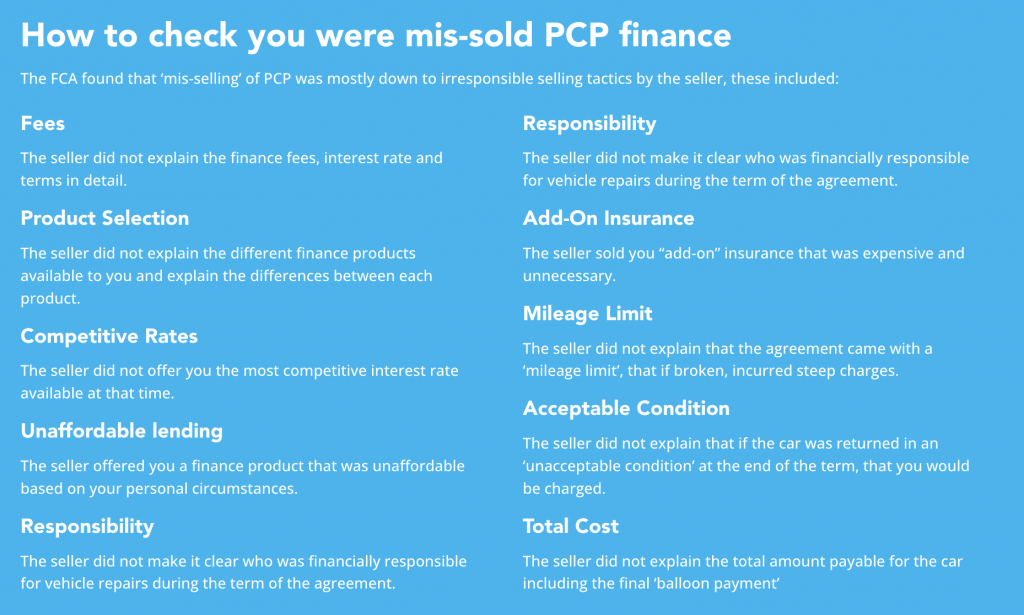

The issue though with PCP Finance is that motorists can negotiate the rates and terms that they pay with car dealers, brokers and motor dealers who may be more or less willing to reduce prices to meet sales targets.

The reality is that two people can walk in to a dealer, but the exact same car, but pay two very different rates and monthly fees – and whilst this has been the case for decades, it lacks transparency and fairness in the market and now refunds are available to millions of motorists.

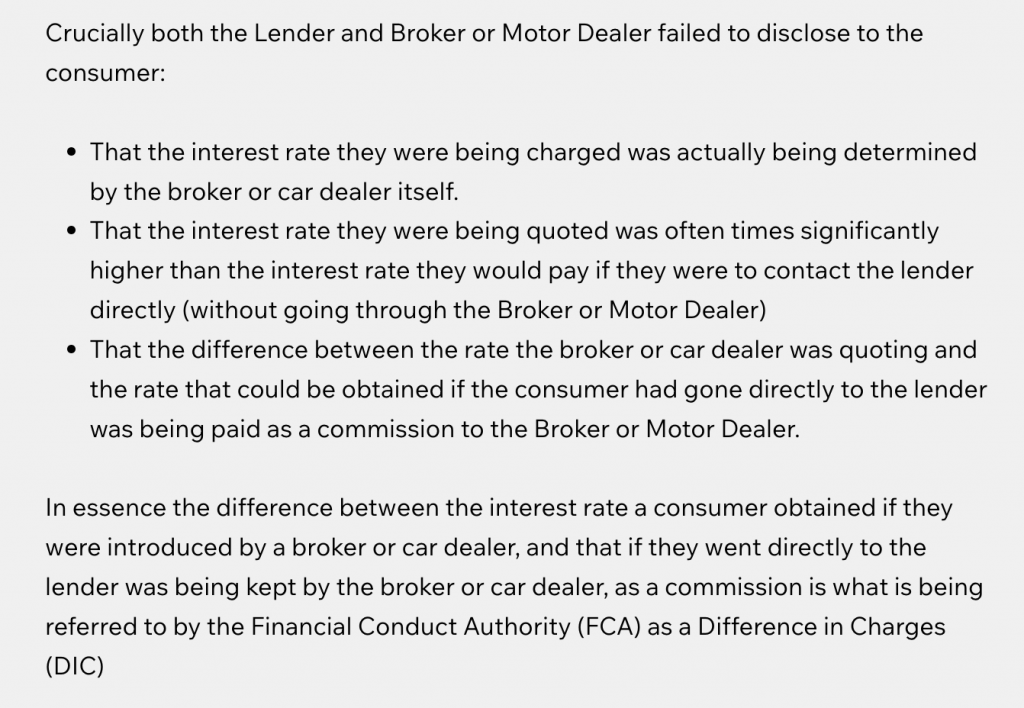

The reason that people can get PCP Finance refunds is because millions of UK motorists have been charged rates that are too high or would have been cheaper if they had contacted the lender directly. Importantly, any difference in price has historically been paid in commission to the broker or motor dealer and this is not transparent or fair to the customer.

As explained by Claim Smart below:

Specifically, the FCA estimates 95 per cent of car finance deals had a commission model, and 40 per cent involved a crucial “discretionary commission arrangements” (DCA).

PCP Finance is claimed against the lender such as Motonovo Finance, Blackhorse or MoneyBarn – or it is otherwise the broker or car dealer that has taken unlawful commission.

Yes, you can be eligible for a PCP finance claim using Claims Bible, based on this information below. Using their checker, you can see if your case is eligible:

The compensation you receive can be a few hundred or even a few thousand pounds depending on the amount of commission you were mis sold and the size of your car finance loan.

A claim can take between 10 weeks and 18 months to be processed and fully paid to you. The compensation will typically be paid to you in one lump sum (not in instalments).

The claims process could be faster if you use a law firm or claims management company could make the process faster and it will certainly help if you have all your documents available, rather than having to dig through and chase them up from old dealers dating back as far as 2007.

Yes, using a law firm or claims management company could charge you up to 36% of the full commission you might get back.

Yes, if you have had multiple vehicles in your household or historic ones that were purchased through PCP finance, you can certainly claim back on multiple ones dating back from 2007.

Yes, like most claims, you can apply for yourself, searching through the Internet for the processes and paperwork required that you need to submit to a motor finance lender. This may take a little longer and may not be as effective. Whilst claims management companies and law firms charge huge commissions, they have everything lined up so you can apply fast and get an answer fast too.

A senior stretch loan can help you purchase a property …

A mortgage offer officially lasts for 3-6 months depending on …

Securing a mortgage when you’re self-employed comes with its own …